Stimulus Package Updates

The COVID Relief Bill was signed into law yesterday, December 27th 2020. In addition to new sources of federal aid for businesses and individuals, the bill includes many changes to existing relief, 2020 taxes and future income taxes. We have included a summary of the key details below.

COVID RELIEF CHANGES:

PPP loans, EIDL grants, and SBA loan subsidies are not considered taxable income, and deductions are now allowed

New and existing PPP loans now include:

Property damage, supplier costs, operation expenditures, and worker protection expenditures as allowable expenses

New forgiveness application for loans under $150,000 (up from $50,000) include no reduction in forgiveness due to changes in wages or number of employees

EIDL grants are no longer deducted from forgiveness eligibility

$600 stimulus checks per adult and child for income up to 75,000 (single), $150,000 (married filing joint), and $112,500 (head of household) <ulstyle="font-size: 16px;">

Prior stimulus checks have no repayment requirement if you are no longer eligible when you file a 2020 tax return

$300/week federal unemployment benefits

New PPP loans up to $2,000,000 are available to businesses who satisfy all of the following:

Have fewer than 300 employees

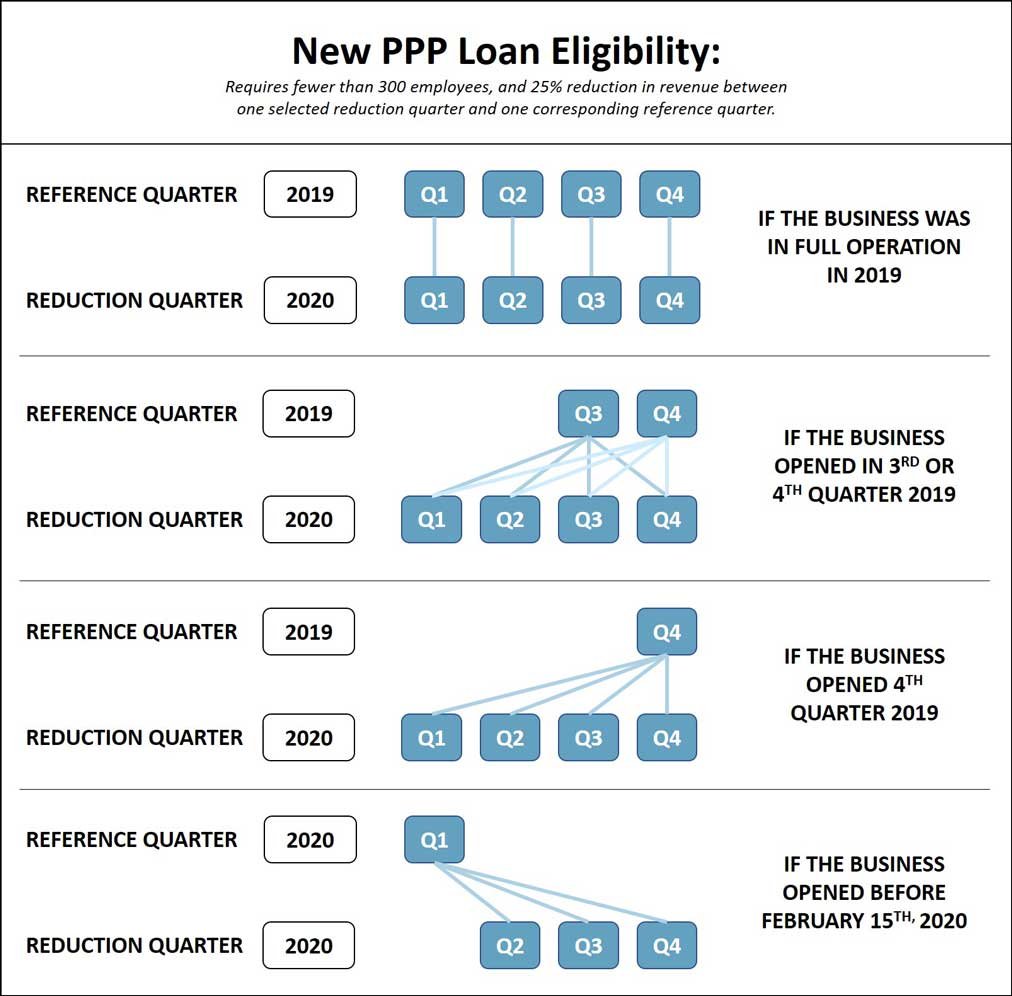

Have at least a 25% reduction in revenue for any quarter in 2020 compared to the same quarter in 2019 (with exceptions for business opened in later 2019 or early 2020)

Were in business before Feb 15th, 2020

Borrowers in bankruptcy and 501(c)(6) organizations are now eligible for PPP loans

New EIDL loans and $10,000 emergency grants for businesses who satisfy all of the following:

Are located in a low-income community

Have at least a 30% reduction in revenue for any 8 week period in 2020 compared to 2019

Have fewer than 300 employees

New EIDL loans will be given priority over prior applications that remained unfulfilled due to lack of funding

Shuttered Venue Operator Grants now available to live venues, theaters, and museums

Recipients are ineligible for PPP loans

Eviction ban has been extended until January 31st, 2021

FFCRA (sick and family leave) credits were extended through March 2021

Sick and family leave credits are now available for self-employed individuals and can be based off prior year net earnings

INCOME TAX CHANGES:

Charitable contributions:

There is no longer a cap on charitable contributions; 100% of your AGI can be deducted in charitable contributions for 2020 and 2021.

Non-itemizers can deduct $300 ($600 if married filing joint) cash donations in addition to the standard deduction

Non-itemizers can deduct $300 ($600 if married filing joint) cash donations in addition to the standard deduction

Business meals and beverages from restaurants will now be 100% tax deductible (an increase from 50%) in 2021 and 2022

Medical expenses exceeding 7.5% of your AGI will now be deductible

PPE, disinfectants, and other COVID related cleaning supplies are now included as a qualified educator expense (up to $250)

Employer payments on student loans are pre-tax deductions until December 31st, 2025.